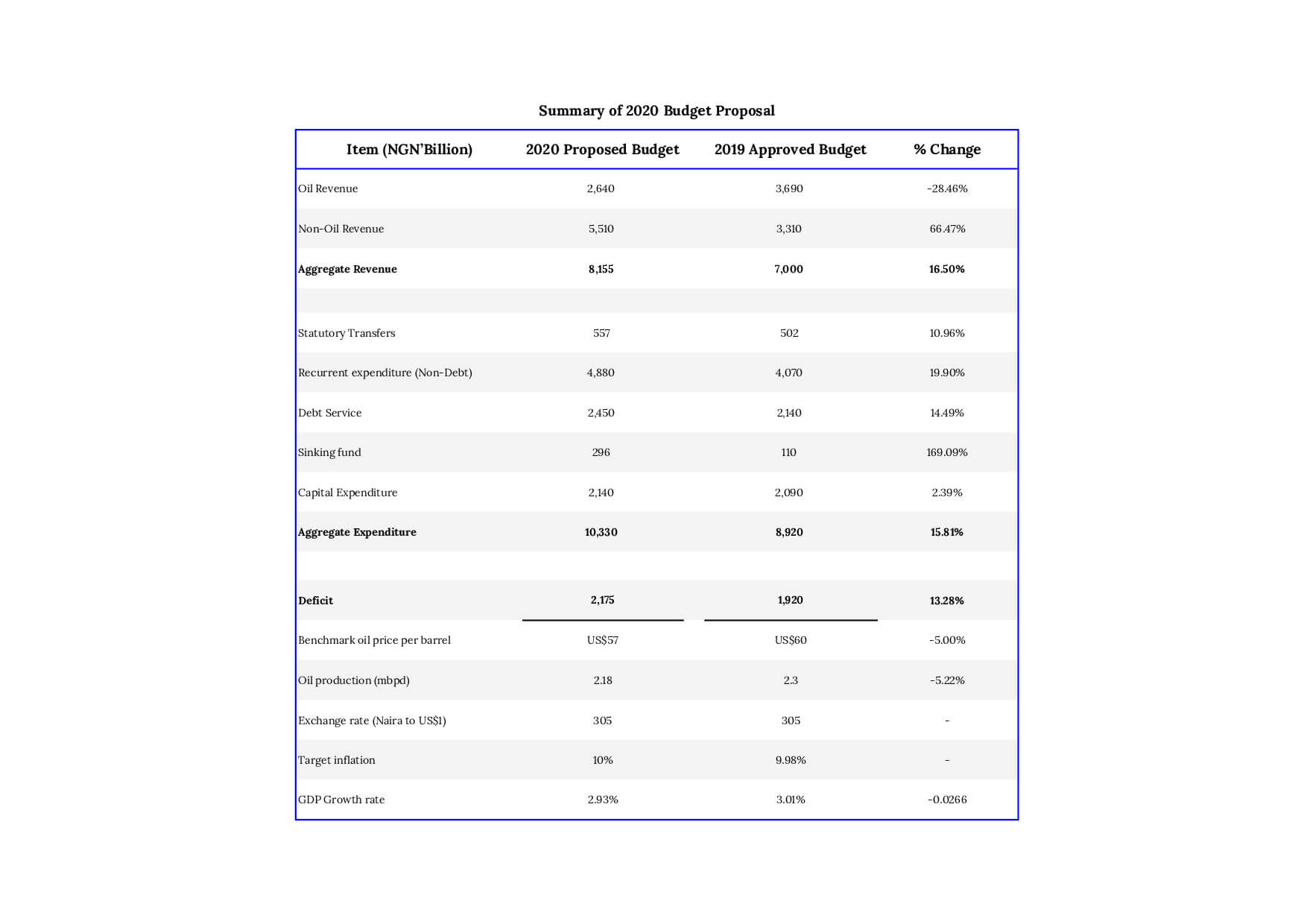

On October 8, 2019, President Muhammadu Buhari presented the 2020 Budget and Finance Bill to the National Assembly for consideration and passage into law. The total revenue available to fund the 2020 budget is projected at ₦8.155 trillion (7% higher than the 2019 Budget of ₦7.59 trillion). Meanwhile, the aggregate expenditure is ₦10.33 trillion, leading to a deficit of ₦2.18 trillion. Also, key assumptions are an exchange rate of ₦305 to the United States (US) dollar, price of crude oil at US$57 per barrel (2019: $60), and an output of 2.18 million barrels per day (mbpd) as presented below.

Furthermore, the Federal Government (FG) intends to finance the 2020 budget with a higher tax rate as well as other reforms. However, any change in the tax law requires an amendment which can be achieved through the passage of a Finance Act rather than amending different legislations one-by-one.

What then is a Finance Act?

A Finance Act is a legislation that contains different provisions on taxes, exemptions, and reliefs. Therefore, the Finance Bill 2019 focuses on five (5) long-term objectives such as:

- lowering cases of regressive taxation and encouraging fiscal equity;

- initiating tax reforms that align with global standards;

- granting tax incentives for investments in infrastructure and capital markets

- creating an enabling environment for the growth of micro, small and medium-sized enterprises; and

- deriving more fiscal revenue.

First, the Finance Bill seeks to increase the value added tax (VAT) rate from 5% to 7.5%. FG will lessen the effect of a higher VAT rate by exempting businesses with a turnover of less than N25 million per annum from VAT registration. In essence, micro, small and medium enterprises that meet the exemption threshold will have lower VAT compliance costs. Nevertheless, the Federal Inland Revenue Service needs to develop a sound mechanism of separating exempt businesses from “VATable” businesses for proper reporting of VAT revenue.

Second, the list of VAT-exempt items cover basic food items such as:

- brown and white bread;

- cereals including maize, rice, wheat, millet, barley, and sorghum;

- fish of all kinds;

- flour and starch meals;

- different kinds of fruits, nuts, pulses and vegetables;

- roots such as yam, cocoyam, sweet and Irish potatoes;

- meat and poultry products including eggs;

- milk;

- salt and herbs of various kinds; and

- natural water and table water.

The Finance Bill 2019 is, therefore, a notable contribution to the economic growth of Nigeria especially as the last Finance (Miscellaneous Taxation Provisions) Decree 1999 was passed two decades ago.

Download….