Businesses often buy items that will generate benefits above 12 months. When these items are also tangible and hard to convert into cash, they are called fixed assets. Each company is free to set a threshold for recognizing fixed assets in its books. A blue-chip company listed on the Nigerian Stock Exchange (NSE) may recognise an item as fixed assets if the amount is above NGN1,000,000. Meanwhile, a medium-sized company could fix a threshold of NGN300,000. As the value of fixed assets reduces, an amount known as depreciation is set aside over the asset’s useful life. Depreciation reduces a company’s profit before tax. Furthermore, a company’s choice of depreciation can lead to various accounting profits. This may also distort taxable profits. Hence, the Companies Income Tax Act (CITA) LFN 2007 allows capital allowance in Nigeria as a deductible expense instead of depreciation.

Definition

Capital allowance in Nigeria is a claim against the assessable profits of a company. It spreads the tax relief for the cost of a qualifying capital expenditure (QCE) over some years. A company cannot reduce its taxable profits with depreciation expense and capital allowance. Taxable profits, holding other adjustments constant, is net profits plus depreciation minus capital allowance. However, a taxpayer must fulfill four (4) conditions to claim capital allowance as the tax relief is not automatic.

Conditions for claiming capital allowance

- The taxpayer making the claim must own the qualifying capital expenditure.

- The company must have incurred qualifying capital expenditure. Under the Nigerian tax law, QCE differs from fixed assets. QCE is the acceptable type of fixed assets that enjoys tax relief.

- The taxpayer must be the beneficial owner of the asset at the end of the basis period.

- The asset must be in use wholly, reasonably, exclusively and necessarily use for company at the end of its basis period. The tax payer must get an acceptance certificate from the Inspectorate Division of the Federal Ministry of Industry for any QCE of NGN 5,000,000 and above. (Business Facilitation Act 2023)

Types of capital allowance

- Initial allowance: One-off relief in the first year of purchasing a QCE. This means initial allowance is calculated only once over the useful life of an asset. It is not recurring.

- Annual allowance: It is a tax relief based on the cost of the asset less initial allowance. As a rule of thumb, a fully depreciated asset that is still retained in the company’s books should not be reported as nil value. Rather, a value of NGN 10 should be reported for each asset.

- Balancing adjustment: It is calculated at the point of disposing QCE.The two types of adjustment are balancing charge and balancing allowance. A balancing charge is when the sales proceeds is higher than the tax written down value. Tax written down value is the cost of the asset less the capital allowance claimed till date. Balancing charge is added to the profits for income tax. On the other hand, balancing allowance arises when the tax written down value is higher than the sales proceeds. Balancing charge is deducted from the profits for income tax. If no capital allowance was calculated on a QCE, then there will be no balancing adjustment in the first instance.

- Investment allowance: Granted once per QCE at 10% of additions to plant and machinery. Finance Act 2023 has deleted the provisions on reconstruction and rural investment allowances in Section 32 and 34 of the Companies Income Tax Act 2004 (as amended). Reconstruction investment allowance is a relief for companies that incur plant and machinery expenditure. On the other hand, companies that provide infrastructure in a community can claim rural investment allowance. The effective date of the Finance Act 2023 is September 1 2023. However, companies that have incurred expenditure on or before September 1 2023 can claim this incentive until it is fully utilised.

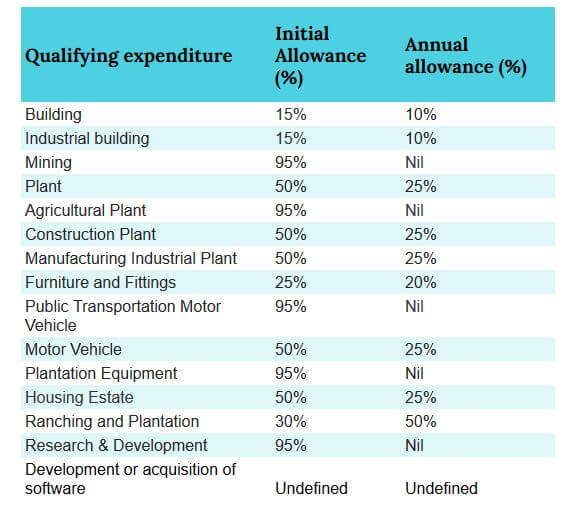

Rates for initial and annual allowances

The price of land increases in value over time. Hence, land does not qualify for either depreciation or capital allowance. However, building on that land qualifies for tax relief. Under the Finance Act 2020, the cost of software or similar capital payments on electronic applications are QCE.

Restriction on capital allowance

The maximum amount that is deductible is two-thirds of assessable profit. This makes a company pay tax on the remaining one-third of assessable profit. However, any company in the agro‐allied industry or a manufacturing company can claim the entire amount, that is, no restriction. Let’s take a look at how to compute capital allowance.

A copy of the relevant provision is in the Second schedule of CITA and to download the Finance Acts, check our Resources Page .