The World Bank (WB) released the much-awaited Ease of Doing Business 2019 Report on 31 October 2018. Each year, WB releases the Ease of Doing Business report which compares business regulation for local firms in 190 economies. Nigeria’s ranking fell from 145 to 146 even though the country improved its rank in 5 parameters. Paying taxes and starting a business recorded the highest improvement.

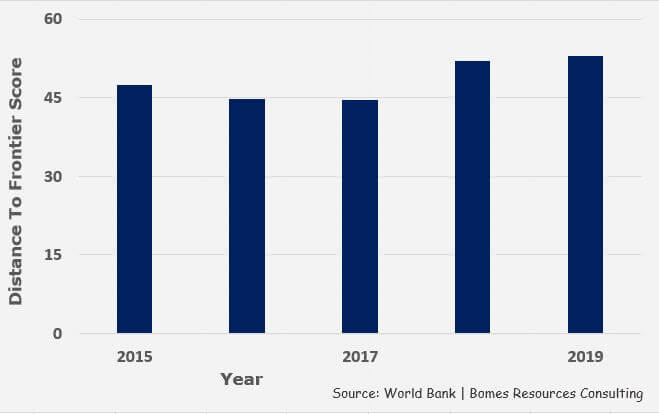

Despite several reforms of the Presidential Enabling Business Environment Council (PEBEC) in the last 12 months, Nigeria did not join the list of top 100 economies. A 5-year historical review of distance to frontier (DTF) score shows that entrepreneurs faced tough business regulations from 2015 to 2017. Favorable policies resurfaced from 2018 to 2019.

Furthermore, a 10-year review of ranking shows how Nigeria fell from 125 (2010) to 170 (2015). All hands are now on deck to push Nigeria into a conducive economy, as shown in 2019 (146).

The country’s rank was extremely lower than its fellow MINT countries (Mexico, Indonesia, Nigeria, and Turkey). MINTs have been classified based on population size, favorable demographics, and emerging economies. Turkey (43) topped the MINT, followed by Mexico (54) and Indonesia (73). Also, Turkey was the most improved economy in comparison with other MINT countries. Meanwhile, a host of Sub-Saharan Africa countries provided friendlier business policies than Nigeria. Mauritius (20), Rwanda (29), Kenya (61), South Africa (82) all feature in the top 100 spots. Other lower-middle-income economies like Lesotho (106), Ghana (114), Egypt (120) and Uganda (127) also outranked Nigeria.

Ease of doing business: Nigeria Vs. Indonesia

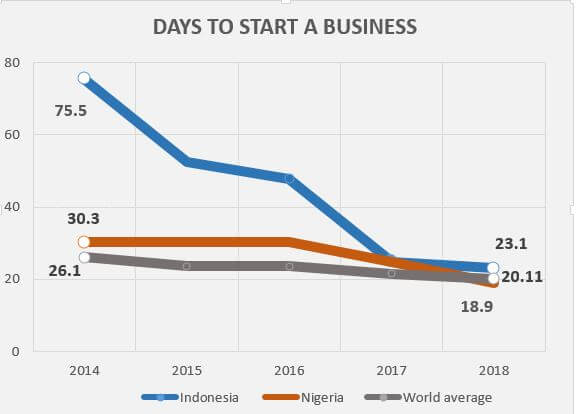

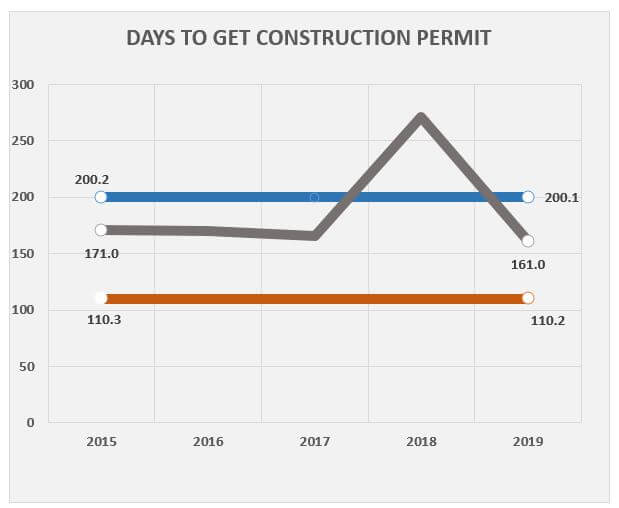

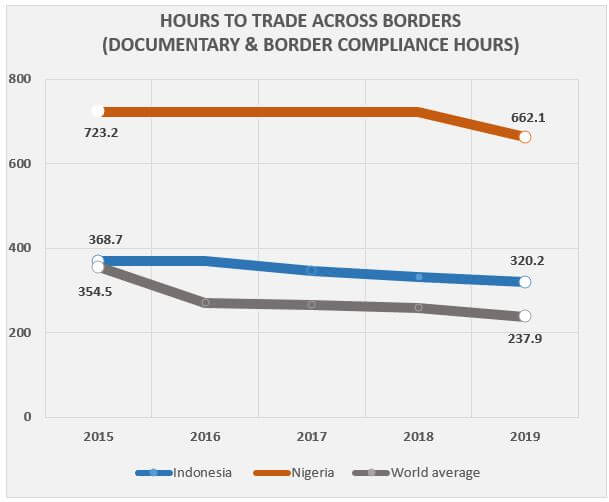

BRC compares Nigeria’s performance in the last 5 years with Indonesia, a lower-middle-income economy under the MINT classification. Data is a population-weighted average for the two biggest commercial states.

The findings accentuate the importance of government initiatives. Relatively, Nigeria lags in parameters where government control is very high: registering a property (184), trading across borders (182), getting electricity (171), and paying taxes (157).

- Registering a property:

Information for property registration was hard to access in Nigeria. Hence, the time for registering property plummeted to 91.7 days (2018: 68.9 days). Conversely, Indonesia reduced the time to settle land disputes and improved the transparency of the land registry. This reform led to an unchanged time for registering property (27.6 days). - Trading across borders:

Nigeria implemented reforms to electronic systems, customs administration, risk-based inspections. Consequently, the country witnessed a shorter duration of 662.1 hours to comply with documentary and border regulations. Reforms on trade policies and transparent regulatory practices that are cost-effective and time-efficient would facilitate international trade. On the other hand, Indonesia recorded no reform in international trade. However, the total compliance hours in Indonesia dropped to 320.2 hours.

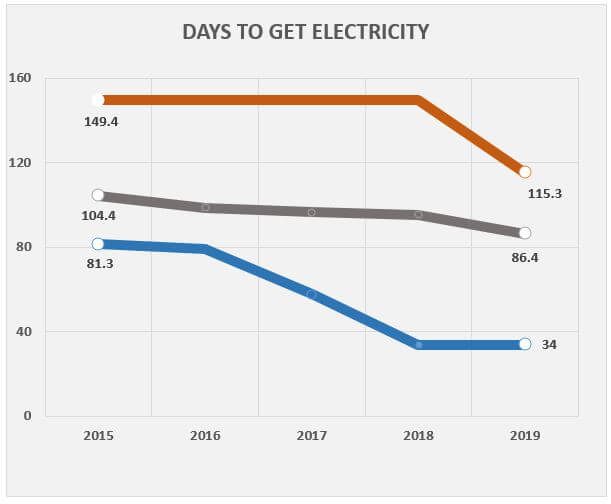

3. Getting electricity:

With the influx of more prepaid meters in Nigeria, residents connected to electricity in 115.3 days (2018: 149 days). Indonesia improved the time frame for new connections and lowered electricity fees in 2016/2017. This reform contributed to an unchanged period of 34 days in the current report.

4. Paying taxes:

Nigeria simplified tax compliance processes in 2016/2017. A taxable person in Nigeria paid taxes in 347.4 hours. The reason is not far-fetched — the simplified process only fulfilled one out of seven categories for complete reform. Nevertheless, reforms in a risk-based tax audit approach and a functional electronic filing system are important. A taxable person in Indonesia paid taxes at a shorter period of 207.5 hours.

In conclusion, Nigeria’s performance in these four parameters drifts farther from Indonesia and the world average.This beckons on the government to continuously pursue long-term policies that would eliminate administrative bottlenecks and reinforce laws that nurture entrepreneurship.

PEBEC’s target to place Nigeria as the top 100 economies by 2019 is no more tenable. However, PEBEC can still realize this dream in 2021. It needs to introduce big-ticket reforms to property law, international trade, electricity and tax laws.