Cessation rule for companies in Nigeria

Basis period is the accounting period for calculating the assessable profits. It could be either a preceding year basis (PYB) or an actual year basis (AYB). A preceding year basis means the assessable profits of the previous twelve-month accounting period is subject to income tax. Existing companies in Nigeria file income tax returns on PYB. On the other hand, an actual year basis is when a company pays tax on assessable profits from January to December.

Companies in Nigeria file their tax returns on a preceding year basis except in “abnormal” cases. Abnormal situations arise for companies with basis period that is greater than or less than twelve (12) months. For instance, when a company starts business or changes accounting date or stops business

What happens to unutilised withholding tax (WHT) credit at cessation?

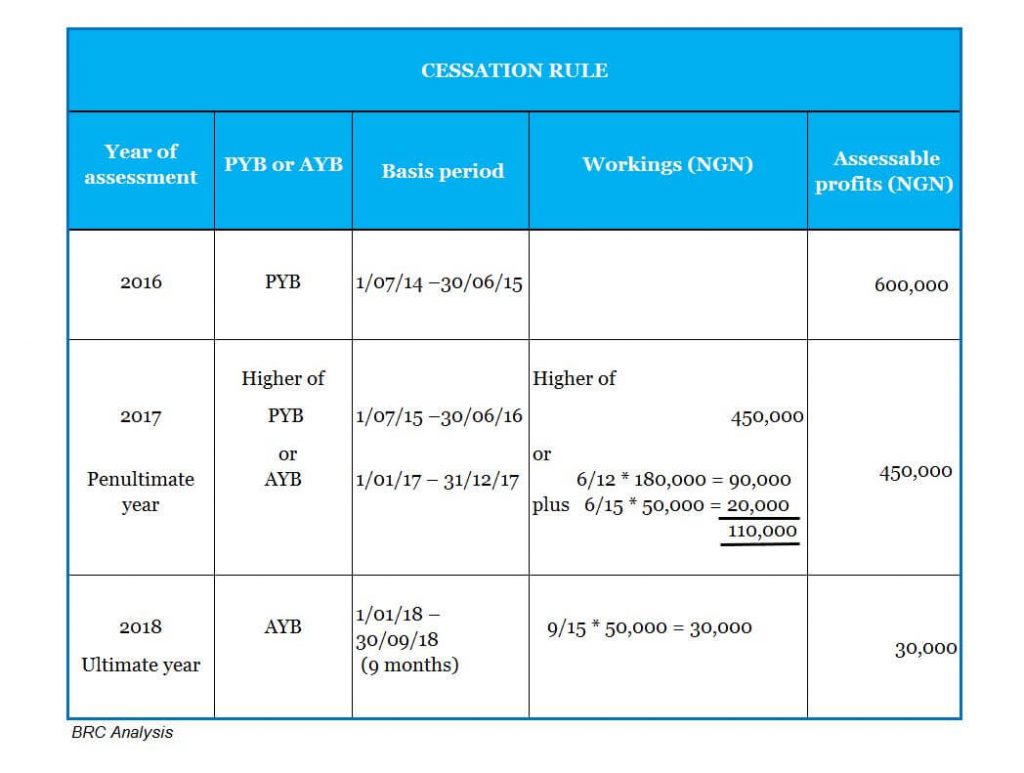

Illustration

XYZ Limited has an accounting year end of 30 June. The company later ceased operations on 30 September 2018 and reported assessable profits in the last 4 years as;

First: July 2014 – June 2015 NGN600,000

Second: July 2015 – June 2016 NGN450,000

Third: July 2016 – June 2017 NGN180,000

Last: July 2017 – September 2018 NGN50,000

Determine the cessation returns due to FIRS.

Solution

Penultimate and ultimate years, according to the cessation rule, are 2017 and 2018 respectively. FIRS will assess XYZ Limited to tax using the higher assessable profits of NGN450,000 under PYB rather than NGN110,000 in 2017. Also, the six (6) months gap in basis period, that is, July to December 2016, escapes income tax. In the ultimate year, assessable profits of NGN30,000 will result in the same tax exposure for XYZ Limited and FIRS.

If your company is facing liquidation, it is important to speak with a liquidation expert early. You may be able to know what to do so as to clear all obligations, including tax debt. Getting the right advice at this point could make a big difference, and help you achieve that desired outcome. You can also check FAQs on companies income tax (CIT) returns.

Effective 13 January 2020, cessation rule will no longer apply to companies that close operations in Nigeria. This is in line with the Finance Act 2019. Such companies will file their returns using the preceding the year basis. Where the date of cessation falls after the financial year end, the CIT returns will be filed from the beginning of the financial year end to the date the company stops operating.