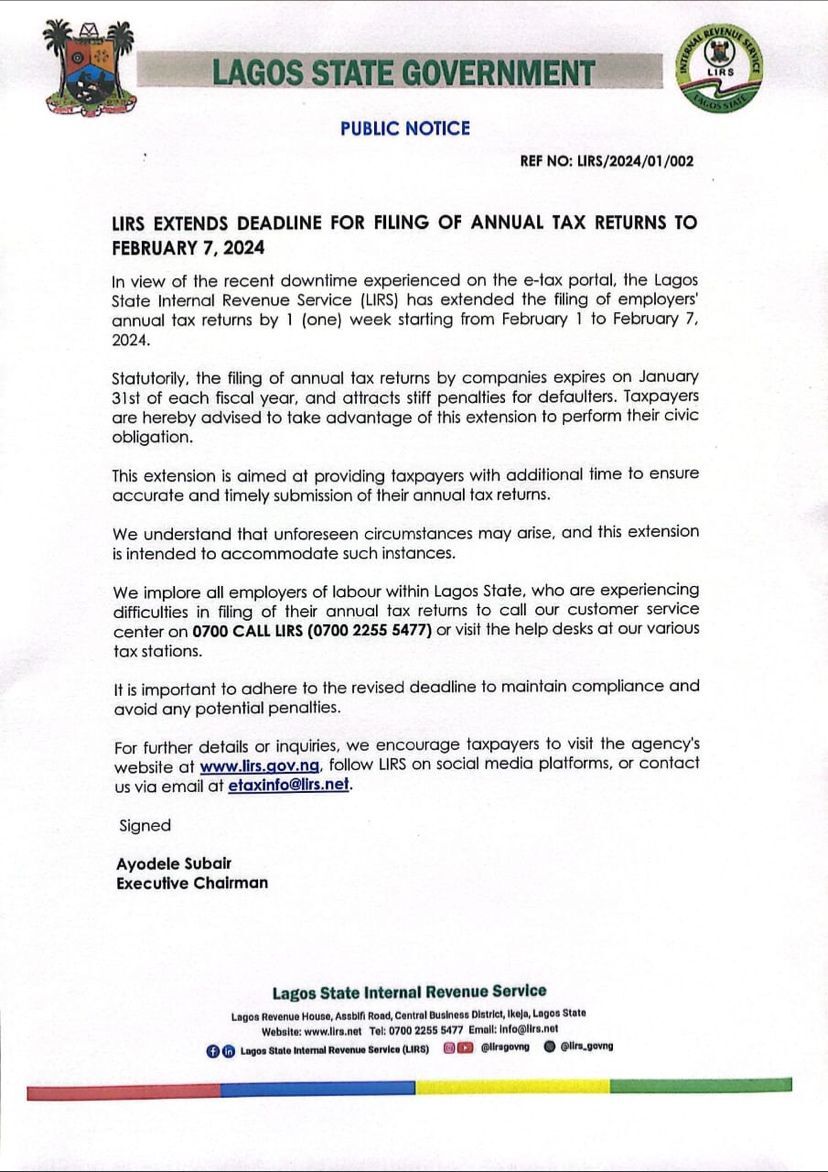

LIRS extends deadline for filing 2023 annual tax returns

There’s good news for businesses in Lagos State, yet to file their annual tax returns. The Lagos State Internal Revenue Service (LIRS) has extended the time to file 2023 tax returns by seven (7) days. The initial due date of…